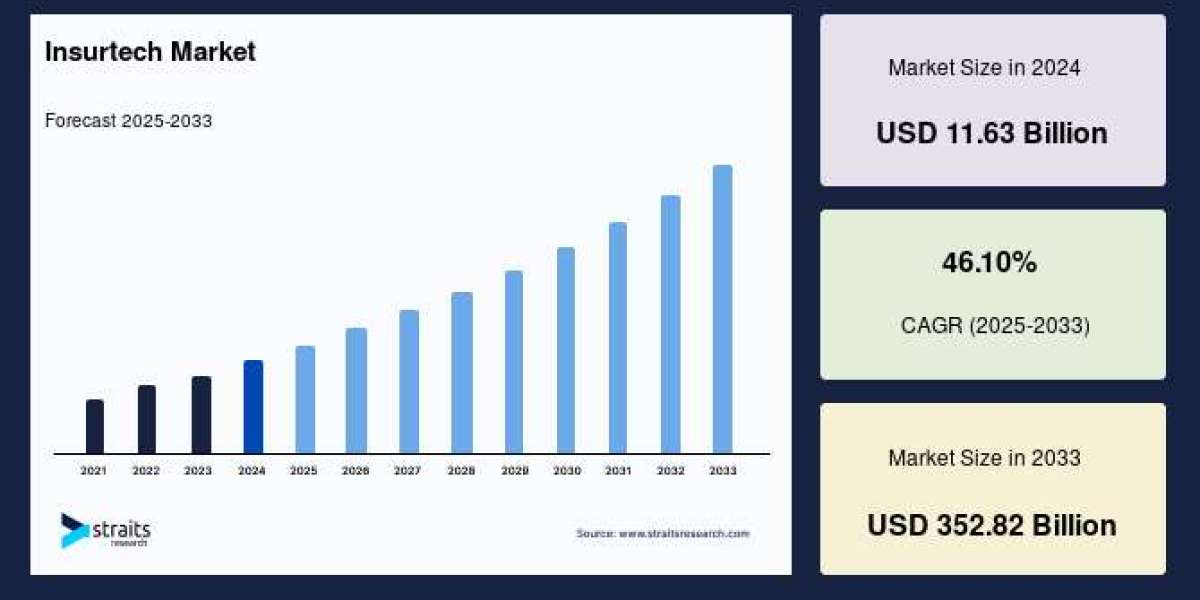

The global Insurtech market is witnessing explosive growth, transforming the way insurance is delivered, managed, and consumed. Valued at around USD 11.63 billion in 2024, the market is expected to climb to USD 17.00 billion in 2025 and further skyrocket to USD 352.82 billion by 2033, recording a remarkable compound annual growth rate (CAGR) of about 46.10% between 2025 and 2033.

Insurtech, a combination of “insurance” and “technology,” leverages innovations such as artificial intelligence (AI), blockchain, the Internet of Things (IoT), and cloud computing. These technologies help insurers cut costs, improve efficiency, detect fraud, and offer customers personalized solutions and faster claims settlement.

Request a Sample Report@ https://straitsresearch.com/report/insurtech-market/request-sample

Market Restraints

Despite its rapid rise, the Insurtech sector faces several challenges:

- Regulatory Hurdles: Stringent compliance requirements across different countries restrict fast innovation and slow down new product launches.

- Trust Issues: Consumers remain skeptical about AI-driven underwriting and digital-first policies, particularly regarding data security and fairness.

- Awareness Gaps: In many developing markets, limited knowledge of digital insurance solutions prevents widespread adoption.

These barriers highlight the importance of balancing innovation with consumer trust and regulatory clarity.

Market Opportunities

The market outlook presents significant opportunities for growth:

- Personalized Products: Insurtech companies are developing usage-based and behavior-driven insurance policies by leveraging IoT devices, telematics, and wearable data.

- Digital Investments: Insurers are allocating higher budgets toward digital transformation, creating opportunities for tech vendors and startups.

- Fraud Prevention via Blockchain: Distributed ledger technology reduces fraud, speeds up claims processing, and enhances transparency.

- Partnerships with Reinsurers: Collaborations between reinsurers and digital-first insurance companies are accelerating innovation and expanding global reach.

These drivers highlight how customer-centric solutions will shape the future of insurance.

Market Segments (XYZ)

The Insurtech market can be divided into key segments:

- By Type (X): Health, auto, home, travel, and specialty insurance.

- By Service (Y): Consulting, support & maintenance, and managed services.

- By Technology (Z): Blockchain, IoT, cloud computing, machine learning, and other emerging technologies.

Each segment plays a vital role in addressing specific customer needs while driving technological adoption across the insurance value chain.

Key Players (AB) with Revenue

Some of the prominent players shaping the Insurtech market include:

- Damco Group

- DXC Technology

- Insurance Technology Services

- Majesco

- Oscar Insurance

- Quantemplate

- Shift Technology

- Trōv, Inc.

- Wipro Limited

- ZhongAn Insurance

- Acko

- Coya

These companies are investing in advanced technologies, digital distribution platforms, and collaborative models to expand their market presence and revenue streams.

Latest Developments & Collaborations

Recent years have witnessed dynamic growth and innovation in the Insurtech space:

- Significant private funding rounds are boosting Insurtech startups, especially in emerging markets.

- Strategic partnerships between international hubs like India and Dubai are creating borderless insurance solutions, blending scale with innovation-friendly regulations.

- AI-based solutions are attracting record levels of investment, though challenges such as deepfake-enabled fraud are emerging as risks.

- High-profile IPOs from Insurtech companies highlight strong investor confidence and underline the sector’s profitability.

These developments reflect a maturing ecosystem where technology, capital, and collaboration fuel rapid progress.

FAQs

Q1: What is the projected size of the global Insurtech market by 2033? A: It is expected to reach USD 352.82 billion by 2033.

Q2: What CAGR is forecasted for the Insurtech market between 2025 and 2033? A: Approximately 46.10%.

Q3: Who are the major players in the market? A: Key players include Damco Group, DXC Technology, Majesco, Oscar Insurance, Shift Technology, ZhongAn, Acko, and others.

Purchase the Full Report@ https://straitsresearch.com/buy-now/insurtech-market

Conclusion

The Insurtech market is on a transformative journey, growing from USD 11.63 billion in 2024 to a projected USD 352.82 billion by 2033. Backed by AI, IoT, blockchain, and cloud solutions, the industry is redefining insurance by offering more personalization, transparency, and speed.

While regulatory hurdles and consumer trust issues pose challenges, the sector’s innovation-driven opportunities outweigh the risks. Collaborations between insurers, reinsurers, and Insurtech startups, along with increasing funding and global expansions, ensure a strong future. Insurtech is not only disrupting traditional models but also laying the foundation for a smarter, tech-powered, customer-centric insurance ecosystem.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision-making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Contact Us Phone: +1 646 905 0080 (U.S.), +44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com