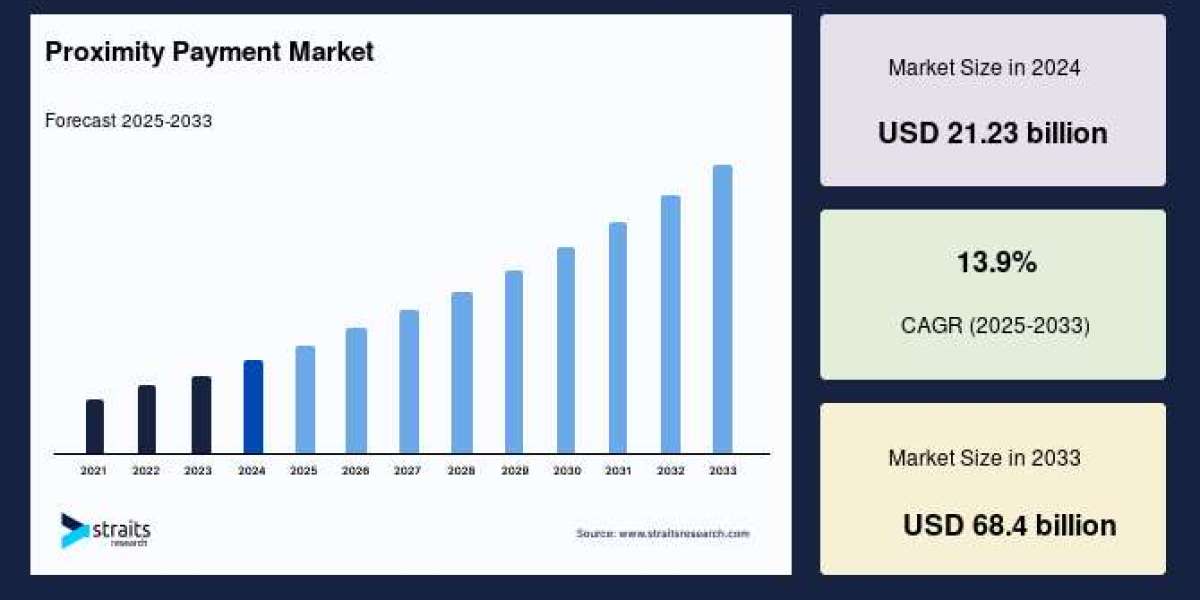

The global proximity payment market was valued at USD 21.23 billion in 2024 and is projected to reach USD 68.4 billion by 2033, growing at a CAGR of 13.9% during the forecast period (2025–2033). Proximity payments enable consumers to make transactions by bringing their smartphones, smartwatches, or contactless cards near a point-of-sale (POS) terminal, typically utilizing Near Field Communication (NFC) technology.

Request a Sample Report@ https://straitsresearch.com/report/proximity-payment-market/request-sample

Market Segmentation

By Offering

Solution: Includes hardware and software components such as NFC-enabled POS terminals and payment applications.

Service: Encompasses transaction processing, security services, and customer support.

By Application

Retail: Grocery stores, bars, restaurants, and drug stores.

Entertainment: Movie theaters, amusement parks, and gaming centers.

Transportation: Public transit systems and toll booths.

Healthcare: Hospitals and pharmacies.

Latest Trends

1. Surge in Contactless Payment Adoption

The COVID-19 pandemic accelerated the adoption of contactless payments due to hygiene concerns. Consumers increasingly prefer the convenience and safety of tapping their cards or smartphones for transactions. This shift has led to a significant rise in the use of NFC-enabled devices and digital wallets.

2. Integration with Mobile Devices

Smartphones and smartwatches are becoming central to the proximity payment ecosystem. With advancements in sensor technology, these devices offer seamless and secure payment experiences. Companies like Apple and Samsung are leading the way with their mobile payment solutions, Apple Pay and Samsung Pay, respectively.

3. Advancements in Security Features

To address security concerns, the industry is focusing on enhancing encryption methods, tokenization, and biometric authentication. These measures aim to protect consumer data and build trust in proximity payment systems.

Challenges

1. Security Concerns

Despite advancements, security remains a significant challenge. Instances of data breaches and fraud can undermine consumer confidence in proximity payment systems.

2. Infrastructure Limitations

In many regions, especially developing countries, the lack of infrastructure such as NFC-enabled POS terminals and reliable internet connectivity hampers the widespread adoption of proximity payments.

3. Consumer Awareness

A lack of awareness about the benefits and usage of proximity payments can slow down adoption rates. Educational initiatives are essential to inform consumers about the advantages of contactless transactions.

Opportunities

1. Expansion in Emerging Markets

Countries like India, China, and Brazil present significant growth opportunities due to their large, tech-savvy populations and increasing smartphone penetration. For instance, India has a mobile payment penetration rate of 80%, with a transaction volume of USD 75.5 billion and a growth rate of 22% .

2. Collaboration with Financial Institutions

Partnerships between payment service providers and banks can lead to the development of innovative solutions that cater to a broader audience. Such collaborations can enhance the reach and functionality of proximity payment systems.

3. Integration with IoT Devices

The proliferation of Internet of Things (IoT) devices opens new avenues for proximity payments. Integrating payment capabilities into everyday objects like wearables and connected appliances can create a seamless payment experience for consumers.

Purchase the Full Report@ https://straitsresearch.com/buy-now/proximity-payment-market

Key Players and Recent Developments

Apple Inc.: Continues to enhance Apple Pay with features like biometric authentication and integration with various financial institutions.

Google LLC: Google Pay is expanding its services globally, focusing on user-friendly interfaces and security enhancements.

Samsung Electronics: Samsung Pay is integrating with more banks and retailers, aiming to increase its market share.

Visa Inc.: Visa is investing in NFC technology and collaborating with merchants to promote contactless payments.

Mastercard Inc.: Mastercard is focusing on tokenization and biometric verification to enhance the security of proximity payments.

Frequently Asked Questions (FAQs)

1. What is proximity payment?

Proximity payment refers to a contactless payment method where consumers can make transactions by bringing their NFC-enabled device, like a smartphone or contactless card, close to a POS terminal.

2. How secure are proximity payments?

Proximity payments employ advanced security features such as encryption, tokenization, and biometric authentication to ensure secure transactions.

3. Which regions are leading in proximity payment adoption?

North America and Europe are currently leading in proximity payment adoption due to advanced infrastructure and high consumer awareness.

4. What are the benefits of proximity payments?

Benefits include faster transactions, enhanced security, improved customer experience, and reduced physical contact, which is particularly important in the post-pandemic era.

Conclusion

The proximity payment market is experiencing significant growth, driven by technological advancements, increased consumer demand for convenience, and the global shift towards contactless transactions. While challenges such as security concerns and infrastructure limitations exist, the opportunities for expansion, especially in emerging markets, are substantial. Key players are continuously innovating to enhance the security and functionality of proximity payment systems, paving the way for a more seamless and secure payment future.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Contact Us

Phone: +1 646 905 0080 (U.S.), +44 203 695 0070 (U.K.)