LED phosphor technology is transforming lighting, display, and automotive industries worldwide as manufacturers race to deliver higher efficiency, superior color rendering, and sustainable products. In 2025, breakthroughs in material science, energy efficiency, and dynamic light control continue to drive fierce competition and rapid adoption. The global push for greener infrastructure and human-centric lighting, paired with evolving automotive requirements, is spurring both innovation and strategic partnership across continents.

According to Straits Research, “The global LED phosphor market size was valued at USD 1.46 billion in 2024 and is projected to reach from USD 1.79 billion in 2025 to USD 8.77 billion by 2033, registering a CAGR of 22% during the forecast period (2025-2033).” This high growth reflects robust demand from smart lighting, automotive, and electronics sectors, as well as the relentless pursuit of energy-efficient solutions.

Key Updates and Recent Advancements

2025 is a turning point for LED phosphor with several significant technology leaps:

Continued investment in narrow-band phosphors and quantum dot integration is raising luminous efficiency and enabling ultra-high color rendering (CRI >95) for premium displays and specialty lighting.

Full-spectrum and tunable white LED designs driven by advanced phosphor blends allow dynamic color temperature adjustment, powering growth in smart, human-centric lighting for homes, offices, and healthcare.

Recent breakthroughs in perovskite phosphor materials and remote phosphor plates are improving thermal stability and color consistency, meeting demands for miniaturized modules and harsher operational environments.

China and South Korea have led rapid R&D expansion in energy-efficient, lead-free, and RoHS-compliant phosphors, enhancing adoption in the context of evolving global environmental regulations.

Industry Leaders and Country-by-Country Developments

The industry’s leading players include Lumileds (Netherlands), Intematix (US), Materion (US), Nichia Corporation (Japan), Mitsubishi Chemical (Japan), Everlight Electronics (Taiwan), Beijing Yuji Science & Technology (China), Yantai Shield (China), Seoul Semiconductor (South Korea), and OSRAM GmbH (Germany).

North America: Intematix and Materion have expanded production of high-efficiency europium-doped phosphors and initiated partnerships with Japanese LED manufacturers to develop next-gen narrow-band red phosphors. The US market leads in automotive, display, and specialty lighting advancements.

Europe: OSRAM and Lumileds are investing heavily in human-centric and smart lighting solutions. Germany is a hub for remote phosphor plate development and efficient synthesis methods, aiming for broader adoption in green buildings and connected infrastructure.

Asia: Nichia, Mitsubishi Chemical, and Seoul Semiconductor have pioneered quantum dot and perovskite phosphor R&D, catering to high-end electronics and automotive clients. China’s Luming Group and Beijing Yuji Science & Technology account for 30% of the world’s phosphor powder supply, leveraging government support to scale capacity and drive aggressive pricing.

Japan: FMM Inc. and local start-ups are tackling miniaturization and long-life phosphors for next-gen displays and rapidly expanding automotive applications.

South Korea: A-Tech and Seoul Semiconductor are focusing on thermal management and environmental compliance, targeting healthcare and horticulture LED segments.

France: French lighting and electronics firms are increasing adoption in energy-efficient applications, supported by government incentives and EU sustainability goals.

Trends Shaping LED Phosphor Growth

Several megatrends are accelerating the adoption and evolution of phosphor technology:

Automotive manufacturers are ramping up LED component integration, with vehicles now containing 50–100 phosphor-converted LEDs each for improved safety, design, and operational lifespan.

Smart and connected lighting systems dominate residential, hospitality, and healthcare deployments, where user-controlled color temperature and spectral composition boost well-being and sustainability.

Environmental regulations and supply chain volatility are driving a shift toward lead-free, rare-earth-efficient, and RoHS-compliant phosphor chemistries. Asia’s manufacturing prowess ensures competitive pricing and reliable global supply.

Innovation in advanced luminescent materials—such as perovskite, quantum dot, and narrow-band emitters—promise new records in luminous efficacy and color quality for displays, automotive, and specialty uses.

Vertical integration and strategic partnerships across continents highlight the fragmented yet fiercely competitive global landscape, with Asian, European, and US leaders continually leveraging R&D strengths and raw materials security.

Recent News and Strategic Initiatives

Materion (USA) announced a 35% increase in europium-doped phosphor output in 2024, supporting the growing demand from global display producers and automakers.

Intematix partnered with a major Japanese LED vendor to develop next-generation red phosphors, enhancing luminous efficacy by over 15% on both sides of the Pacific.

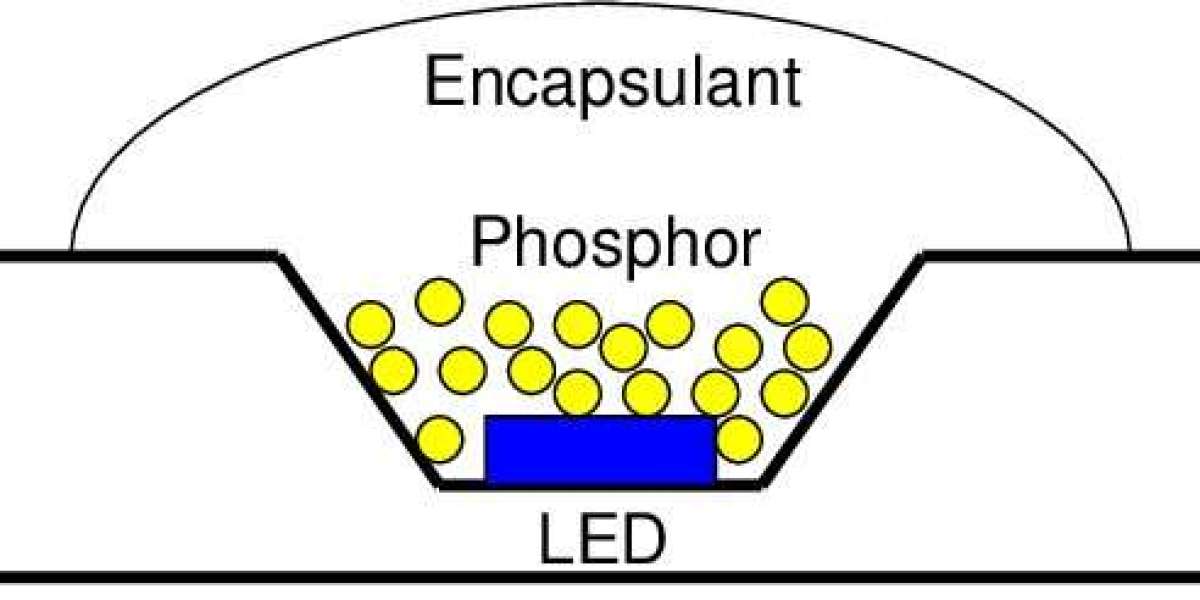

OSRAM is investing in low-temperature synthesis and advanced encapsulation to improve performance and product lifespans for smart city infrastructure and medical lighting.

Luming Group and Beijing Yuji Science & Technology revealed aggressive pricing strategies and massive plant expansions, cementing China’s dominance in phosphor supply for high-growth regions worldwide.

Seoul Semiconductor and A-Tech (South Korea) pursued new environmental compliance programs and thermal management R&D, targeting the expanding healthcare and horticultural LED sectors.

Mitsubishi Chemical and Nichia (Japan) advanced quantum dot and perovskite phosphor commercialization, enabling groundbreaking display and specialty lighting products with ultra-high CRI ratings